Share

0

/5

(

0

)

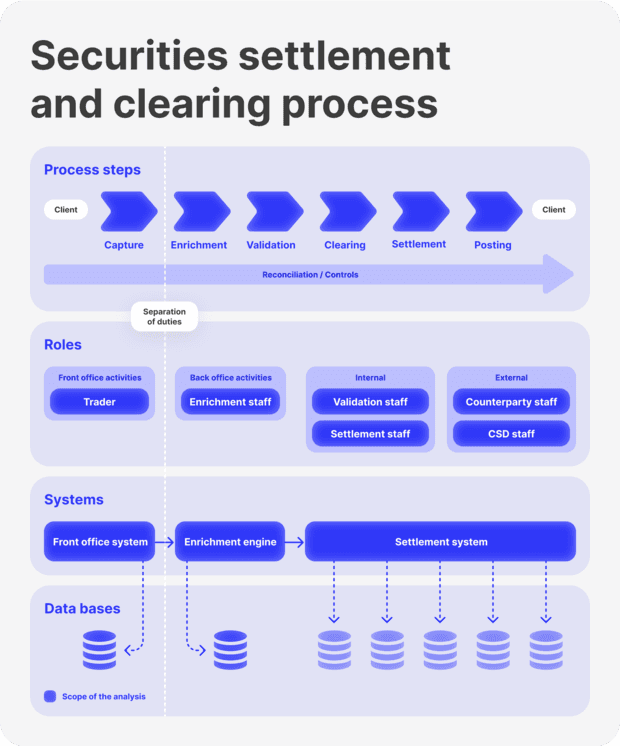

Although the visible part of the process of buying/selling financial assets is lightning fast, its hidden part has a complex structure, including several complicated operations performed before and after the order execution, in particular, the settlement process for the official registration of the transaction and its documentary reflection in the order book.

Today, there is a broker's type that simplifies the process of order processing and independently conducting all necessary operations on deals, including clearing ones, which gives them certain advantages. Such brokerage companies are called self-clearing.

Key Takeaways

Self-clearing brokerage houses its own system for clearing financial transactions, eliminating the need to use third-party companies.

Self-clearing dealers have great advantages in the quality of work, having full control over the clearing process and being able to trade short.

What is a Clearing Firm?

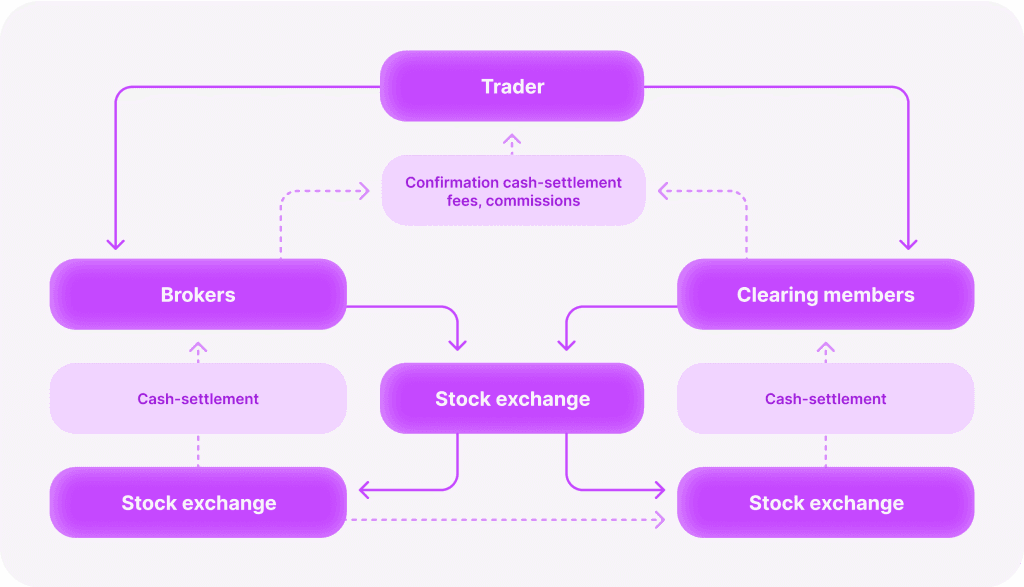

To understand what is a clearing firm, let’s dive into its definition first. A clearing company, also often called a clearing house, is a special financial institution with the necessary authority to carry out all settlements for trade transactions. This institution reviews the transaction and directly manages the process of its regulation. In this case, the clearing firm selects buyers and sellers, taking on all legal and financial risks within the framework of the transaction.

The settlement process ends when the funds are received in full. This process lasts for several working days and is called T+2 (the date when the deal was concluded + 2 additional days). It is worth noting that traders have a special advantage in the trading process thanks to margin accounts, which allow placing more orders without waiting for actual settlements because the funds are borrowed and returned after the deal is closed. However, in most cases, brokers delegate this function to a clearing company that settles transactions for a certain fee because such a back-office is very expensive and time-consuming for many of them.

The value of clearing firms must be considered, as their role in the settlement process is incredibly significant. They are also important in borrowing financial instruments for short trading. As practice shows, an exceptional privilege of clearing firms is the ability to hold many trading assets for this style of trading. In this case, many brokers often cooperate with several clearing companies at a time to find financial assets for their clients that can be used for short trading. Despite the electronic format of conducting this procedure, it may require more effort and time to conduct when dealing with hard-to-borrow trading assets. Among other things, clearing firms are responsible for ensuring the funding and delivery of financial assets between counterparties.

[aa quote-global]

Fast Fact

Aside from clearing brokers, other categories of broker-dealers are not permitted to clear trades.

[/aa]

What is a Self-Clearing Brokerage Dealer?

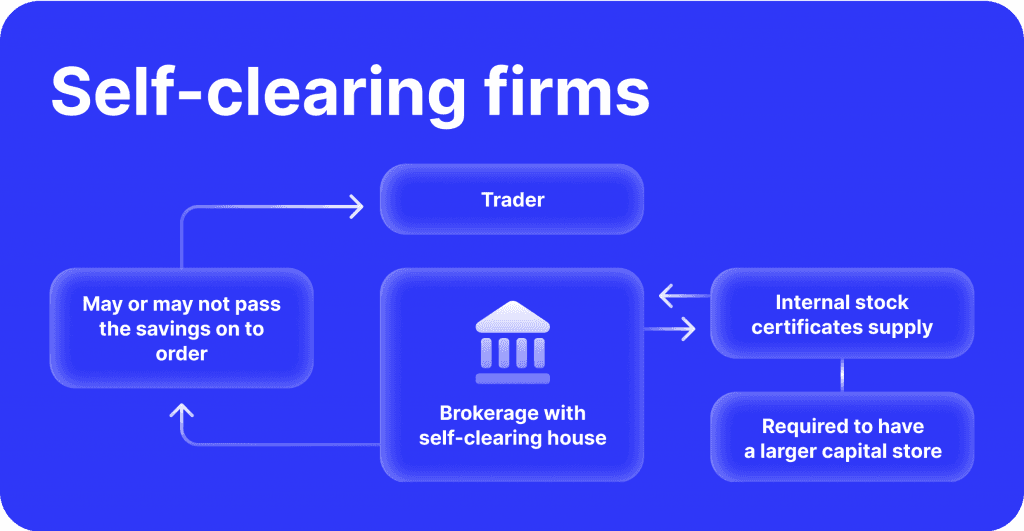

There are special brokers on the market that have the necessary resources to carry out the clearing process. This type of broker, among other things, actively carries out settlements on all transactions and acts as a clearing house, which explains its name – self-clearing. Thanks to the presence of special systems, they conduct all transactions without the participation of third parties, which significantly reduces the costs incurred in the process of cooperation with them.

By design, this type of broker belongs to vertically integrated financial organisations, which have the entire range of unique software in their arsenal for performing essential functions for conducting financial transactions within the back office. Self-clearing firms control everything from market access and the launch of the trading process to the settlement process and clearing operations, which significantly contribute to the efficient completion of transactions (trades). As a result, self-clearing brokers have an undeniable advantage in terms of convenience and speed, offering their clients an exceptional trading experience by controlling and managing all processes independently.

Self-clearing brokers are rightfully the foundation of the securities market, as their professionalism and extensive knowledge help ensure the clearing system's efficiency and smooth operation. Thanks to them, it became possible not only to process orders to buy or sell securities instruments but also to carry out operations on investment portfolio management, including storage of other assets of clients (e.g., management of cash flow on the account). Because they are responsible for the custody of traders' assets, self-clearing broker-dealers strive to maintain a higher level of capital requirements than introducing brokers (IBs) and are responsible for the allocation of investor funds and financial assets at their disposal.

What Are the Strengths of a Self-Clearing Broker Dealer?

As mentioned above, a broker with a self-clearing system conducts all trading operations within its resources. Due to this, this type of broker has weighty advantages compared to brokers that do not have this system. Let's consider the main ones below.

1. Effectiveness

In those cases when a broker uses external systems of clearing financial transactions, all operations within the framework of such cooperation can go against the interests of the brokerage firm and the clearing company, which can cause low efficiency of the broker's work and infringement of its income from traders' transactions. The availability of own clearing processing system provides full control over all clearing processes, which allows for increasing the efficiency of the trading process, as well as to easily regulate various parameters, including cash flow, margin requirements and the like.

2. Control

If end-to-end trade clearing is managed within the firm, the broker has more control over the trade settlement procedure. A vertically integrated business model gives the brokerage firm total authority. Without a middleman, it is possible to identify and address any inconsistencies immediately without consulting a third party. Even though mistakes in trade settlement are uncommon, it is helpful to know that any problems may be quickly and effectively resolved in one location. Using this one-stop-shop concept, customers can avoid interacting with multiple layers of intermediaries to be held responsible for their purchases. More deals equal more clearing with a single point of contact for the customer and back-office, increasing the value of brokers specialising in specific client groups, such as active traders.

3. Short Selling Function

The important role of clearing firms in the market is due to the availability of short-selling opportunities. When traders and investors use borrowed (margin funds) to trade short, they are actually borrowing money from a clearing firm. This phenomenon is due to the fact that the clearing house holds an incredibly large number of stock certificates, which consequently allows them to conduct financial transactions internally. However, there are certain aspects to this process. For instance, in cases where difficulties arise in order to borrow certain types of shares, clearing houses that conduct financial instrument lending have to collaborate with various financial institutions in order to be able to borrow even more shares. This feature of broker dealer clearing firms is undeniably advantageous because it allows traders who actively use a shorting style of trading to borrow more shares.

Conclusion

The role of self-clearing broker dealers is of paramount importance when trading securities, taking into account the high-quality clearing of financial transactions. Like the introducing broker dealer, the self clearing dealer has a high level of capital to provide a high level of service in the process of trading financial assets within self-regulatory organisations.

Read also